Lecture

讲座会议

Report

报告著作

-

数字金融:数字化的金融强国之路《数字金融:数字化的金融强国之路》由黄益平、黄卓、谢绚丽主编。本书对如何做好数字金融这篇大文章、走好数字化的金融强国之路进行了分析和探讨,指出我国的金融强国建设就是一条数字化的金融强国之路。2025.11.04

数字金融:数字化的金融强国之路《数字金融:数字化的金融强国之路》由黄益平、黄卓、谢绚丽主编。本书对如何做好数字金融这篇大文章、走好数字化的金融强国之路进行了分析和探讨,指出我国的金融强国建设就是一条数字化的金融强国之路。2025.11.04 -

数字金融(新文科数字经济系列教材)数字金融(新文科数字经济系列教材)由黄益平、黄卓、沈艳 主编。本书全面梳理了数字金融的全球发展概况、业务模式、基础设施及其对经济和市场的影响。全书分为16章,具体内容包括:第1章为导论,介绍数字金融基本概念和本书特色。第2章讨论数字金融的国际发展格局,涵盖其总体趋势、区域发展及关键影响因素,并分析各地案例。第3-11章聚焦不同业务模式,包括数字支付、征信、信贷、供应链金融、财富管理、保险和数字货币等,探讨其发展历程、创新技术及监管挑战;其中特别关注中国经验,如中国的数字支付、个人征信和大科技信贷案例。第12-14章着重论述数字金融中的大数据分析与治理、监管政策及测度方法。第15-16章探讨数字金融对金融市场和经济发展的影响,从交易成本到宏观政策传导,再到收入差距和数字鸿沟,全面分析数字金融的潜力与挑战。 本书以翔实的案例和数据分析构建了数字金融的研究框架,可作为高等院校经济金融类专业本科生教材,也可作为从业者深入了解数字金融前沿问题的参考书。2025.08.22

数字金融(新文科数字经济系列教材)数字金融(新文科数字经济系列教材)由黄益平、黄卓、沈艳 主编。本书全面梳理了数字金融的全球发展概况、业务模式、基础设施及其对经济和市场的影响。全书分为16章,具体内容包括:第1章为导论,介绍数字金融基本概念和本书特色。第2章讨论数字金融的国际发展格局,涵盖其总体趋势、区域发展及关键影响因素,并分析各地案例。第3-11章聚焦不同业务模式,包括数字支付、征信、信贷、供应链金融、财富管理、保险和数字货币等,探讨其发展历程、创新技术及监管挑战;其中特别关注中国经验,如中国的数字支付、个人征信和大科技信贷案例。第12-14章着重论述数字金融中的大数据分析与治理、监管政策及测度方法。第15-16章探讨数字金融对金融市场和经济发展的影响,从交易成本到宏观政策传导,再到收入差距和数字鸿沟,全面分析数字金融的潜力与挑战。 本书以翔实的案例和数据分析构建了数字金融的研究框架,可作为高等院校经济金融类专业本科生教材,也可作为从业者深入了解数字金融前沿问题的参考书。2025.08.22 -

数字金融前沿文献导读《数字金融前沿文献导读》由北京大学谢绚丽教授主编,北京大学出版社于2024年5月出版。该书聚焦数字技术对金融行业的革新作用,系统梳理国际学界在数字金融领域的最新研究成果。2024.05.31

数字金融前沿文献导读《数字金融前沿文献导读》由北京大学谢绚丽教授主编,北京大学出版社于2024年5月出版。该书聚焦数字技术对金融行业的革新作用,系统梳理国际学界在数字金融领域的最新研究成果。2024.05.31

Research

学术研究

-

Digital institutions and virtual involvement of born-digital firmsBorn-digital firms increasingly pursue virtual involvement, a digital market-entry strategy that prioritizes iterative data collection and algorithmic adaptation over physical expansion. We measure virtual involvement by the number of unique digital advertisements and define it as the intensity of a firm’s digital experimentation to collect user data, train algorithms, and enable continuous learning through a recursive feedback loop. Using a novel panel dataset covering 194 US and Chinese born-digital firms across 33 countries from 2016 to 2022, our empirical analysis finds that stringent host-country digital privacy regulation significantly reduces virtual involvement. This negative influence is weakened in larger digital markets, for firms from home countries with robust digital regulatory regimes, and when firms receive positive public sentiment. These results extend institutional theory and non-traditional entry mode research by introducing virtual involvement as a new dimension of international strategy under regulatory constraints. For policymakers and managers, our study offers actionable guidance: strict privacy rules protect user welfare, but supportive market conditions and regulatory experience are critical to sustaining data-driven innovation. Policymakers should balance user protection with market dynamism, while firms should leverage large markets and positive sentiment to maintain their virtual involvement.2025.11.18

-

Does FinTech reduce human biases? Evidence from advisory vs. automated FinTechs in lendingWe investigate whether FinTech can mitigate human biases in lending decisions using proprietary loan-level data from a Chinese auto equity lender. The lender first integrated big data credit scoring as an advisory tool to enhance its traditional lending model, subsequently transitioning to algorithmic decision-making with optional human override. Our findings reveal that cognitive biases decrease significantly when loan officers use algorithmic lending decisions, substantially reducing disparities in loan-to-value ratios between local and nonlocal borrowers without exacerbating default differentials. Notably, the discretionary adjustments made by loan officers remain modest. In contrast, advisory credit scores alone exhibit no discernible bias-reducing effects. Our study is among the first to demonstrate that automation and choice architecture – specifically, nudging via algorithmic defaults – is more effective than mere information provision in combating discrimination and promoting financial inclusion.2025.10.22

-

流量撬动质量:基于数字经济下内容市场的研究数字经济为内容市场注入庞大的流量,内容经常因其质量参差不齐引起极大争议。本文通过构建原创媒体与转载媒体竞争的理论框架,系统研究流量对内容质量的影响机制,探讨内容市场化量为质的规制思路。研究发现,相较于传统经济,数字经济下流量通过扩容效应、引流效应、覆盖效应这三类积极作用与挤占效应这一消极作用影响内容市场。当网络外部性较强时,引流效应占优,市场实现流量与质量的兼得,引流效应叠加扩容效应与覆盖效应也促使各方福利提升。进一步地,市场监管的加强能够改善网络外部性较弱的内容形式的质量。与自由转载相比,付费转载的治理方式能够提升原创媒体利润与社会总福利。本文为中国内容市场治理体系的完善提供了方向,对推动数字经济健康发展具有重要意义。2025.07.01

-

Prediction Intervals of Panel Data Approach for Programme EvaluationWe consider the inference on individual and time specific treatment effects on the treated within the framework of panel data approach for programme evaluation. We formulate the target problem as constructing prediction intervals for high-dimensional linear regressions with weakly dependent data. Post-LASSO OLS is used for estimation, while dependent wild bootstrap and simple residual bootstrap are used for the construction of prediction intervals. The proposed prediction intervals are proved to have asymptotic validity as the number of pretreatment times goes to infinity. In the proof, we also establish the model selection consistency of LASSO for dependent data and under bootstrap measure, which may be of independent interest. Monte Carlo experiments illustrate that our method outperforms existing methods in finite samples under a wide variety of data generating processes except nonstationary data. Two empirical applications are also provided.2025.05.19

Research

指数编制

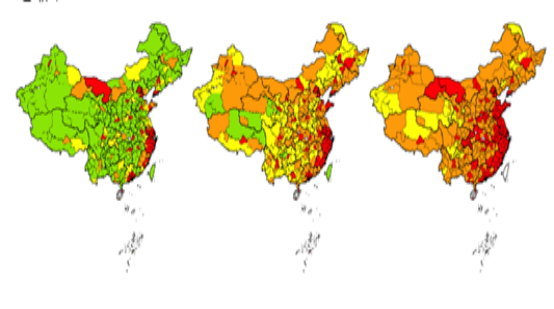

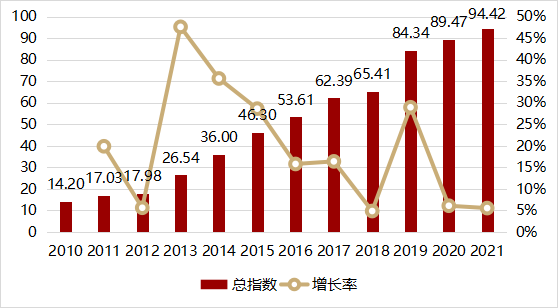

北京大学数字普惠金融指数

北京大学数字普惠金融指数,由中心研究团队与蚂蚁集团研究院合作编制,包含31个省、338个地级市以及约2800个县的2011-2021年数字普惠金融指数,并细分为数字金融覆盖广度、数字金融使用深度和普惠金融数字化程度等分指数。指数研究团队主要成员包括:郭峰、王靖一、程志云、李勇国、王芳等。